Have you ever wondered what it takes to become a bank manager? It’s one of those roles that comes with respect, responsibility, and, let’s be honest, a pretty attractive paycheck. With over 24% growth in demand for entry-level roles in the BFSI (Banking, Financial Services, and Insurance) sector this year, the banking industry is buzzing with opportunities. And with the rise of digital banking and more branches opening nationwide, there’s never been a better time to step into this field.

Now, you might be thinking—how do I get started? Don’t worry! We’ll break it all down, step by step, from qualifications and skills to cracking exams and exploring career paths. Whether you’re fresh out of college or planning your next career move, this guide has everything you need to chart your path to becoming a bank manager.

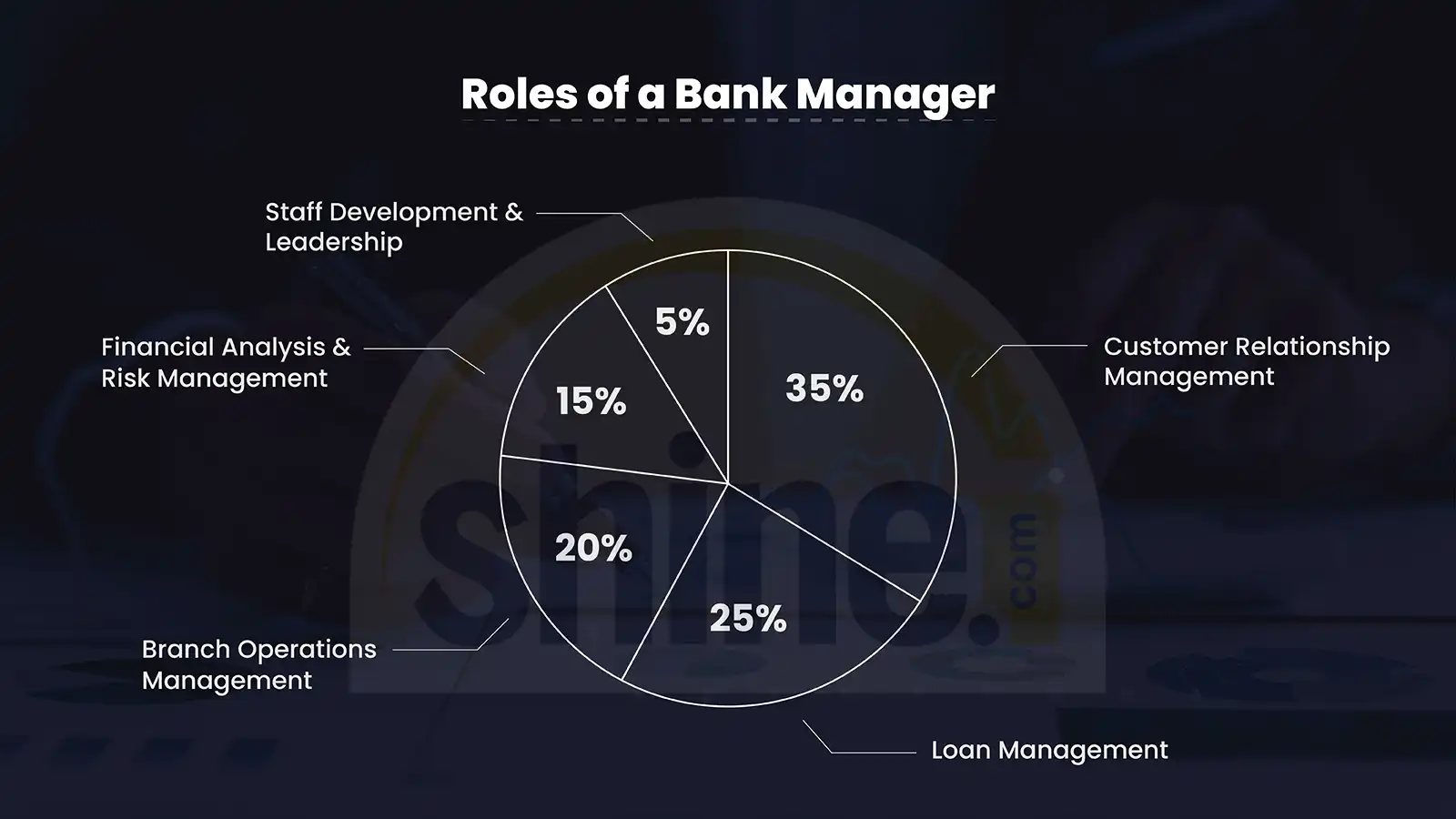

What is the Role of a Bank Manager?

Think of a bank manager as the captain of a ship. They’re in charge of steering the branch in the right direction, managing daily operations, ensuring customer satisfaction, and motivating the team to meet financial targets. Whether it’s maintaining compliance with regulations or building strong customer relationships, this role is all about leadership, strategy, and problem-solving.

Eligibility to Become a Bank Manager

You need a bachelor’s degree, preferably in a related field. After graduation, you have to clear banking competitive exams like IBPS PO and SBI PO. You can do post-graduation but it is not mandatory to clear a banking job. With 2-3 years of banking experience as PO you may get promoted to Manager profile.

Process to Become a Bank Manager

- Complete Your Education

If you’re clear about this career path, start with a degree in commerce or business. Keep your grades above 50% to meet eligibility requirements for competitive exams. - Skills

You need the following skills to outperform in your banking career:-Excellent Communication skills

-Leadership skills

-Adaptability

-Appreciating different culture

-Knowledge of banking regulation - Crack Competitive ExamAfter completing you will need to pass exam like:

-IBPS PO

-IBPS RRB PO

-SBI PO

-NABARD Grade B

-RBI Grade B - Gain ExperienceYou need at least 2-3 years of entry-level experience in a banking role to get a Manager profile. You should maintain a strong professional track record. You can earn certification to enhance your banking and finance knowledge.

Related: Banking Online Courses

Career Path of a Bank Manager

The journey to becoming a bank manager isn’t just about reaching the destination—it’s about growing, learning, and building a career you’re proud of. And the best part? You don’t have to figure it all out at once. Take it one step at a time, and soon, you’ll be at the helm of your own banking branch, making key decisions and driving success. Sounds exciting, doesn’t it?

How Long Does it Take to Become a Bank Manager?

Generally, it took 6-8 years to become a bank manager after 12th. The timeline may vary depending upon different factors like performance, qualification, and career path you choose. You may make fast progress with strong performance.

Difference between Private Sector v/s Government Sector Banking

|

Aspect

|

Private Sector Banking

|

Government Sector Banking

|

|

Salary and Benefits

|

High Salary with a performance-based bonus

|

Moderate salary with standard benefits

|

|

Career Growth

|

Fast growth

|

Fixed growth as per set criteria

|

|

Work Environment

|

Dynamic and fast-paced

|

More stable

|

|

Job Security

|

Less Secure

|

High Job Security

|

|

Work-life Balance

|

Often long working hours

|

Better work-life balance

|

|

Retirement Benefits

|

Varied retirement benefits

|

Strong pension plan and retirement security

|

|

Pressure

|

High-pressure environment with performance targets

|

Less competitive, lower performance pressure

|

|

Global opportunities

|

More opportunities to work abroad

|

Mostly domestic

|

|

Social Respect

|

Good

|

High social status and respect in society

|

|

Innovation

|

Quick adoption of new technologies

|

Slower to innovate

|

How to Become a Bank Manager Abroad?

You have to take care of some more parameters when you are planning to go abroad for a banking profile. Follow these steps to secure your bank job abroad:

-

Understand the banking industry in the target country

-

Ensure your educational qualifications are recognized in that country

-

Gain experience in a multinational bank

-

Research the visa and work permit requirements

-

Do Global certifications

-

Connect with people who are already doing what you are looking for

-

Apply for a bank job

-

Consider the cost of living and cultural differences

Related: Banking Interview Questions

Types of Bank Managers

They supervise different banking operations. Depending upon their area of responsibility, they are of the following types:

- Branch Manager

They manage the operations of specific bank branches. They ensure customer satisfaction, meet sales goals, and maintain regulations within staff. They also develop effective strategies to increase branch profitability. - Operation Manager

They ensure all internal processes run smoothly. They focus on improving workflow and reducing costs. They handle back-office functions. - Relationship Manager

They manage relationships with key clients, typically in corporate or private banking. They work closely with clients to understand their needs. They manage client-portfolio and cross-sell bank services. - Credit Manager

They look after the bank’s credit operation, including the assessment and approval of loans and credit products. They evaluate credit applications and set policies to minimise credit risk. - Treasury Manager

They manage the financial assets and ensure the bank has enough funds to meet its obligations and optimise ROI(return on investment). They manage cash flow and handle foreign exchange transactions. - Wealth Manager

They offer investment advice and ensure client wealth grows while mitigating risk. - Compliance Manager

They ensure the bank complies with all relevant laws, regulations, and internal policies. They implement compliance programs, conduct audits, and train staff on compliance matters. - Loan Manager

They look after the loan processing, underwriting, and approval processes. They develop loan policies, review loan applications, manage loan portfolios, and ensure smooth processing of loans as per regulations. - Retail Banking Manager

They manage retail banking operations and develop and promote retail products. They focus on products and services for individual customers such as personal loans and saving accounts. - Risk Manager

They conduct risk assessments and implement risk management frameworks. They monitor risk exposure and ensure compliance with risk policies. They develop strategies to minimise financial losses.

Bank Manager Salary in India

As per the research of 2024, the average pay for a bank manager is INR 8,64,370. However, it can vary depending on the bank and work location.

|

Experience(years)

|

Average Salary(LPA)

|

|

0-5

|

6

|

|

6-10

|

8.6

|

|

11-15

|

9.4

|

|

16-20

|

12.7

|

|

20+

|

14

|